Feel free to play around with the categories and make sure to update them regularly as your personal and financial needs change. needsĪll of our wants and needs are different, and you might have to tweak the spreadsheet to make it work for you.įor example, maybe travel expenses are actually a “need” for you because you travel for work or a gym membership is non-negotiable.

Excel budget workbook how to#

What if you’ve budgeted for your wants and needs and don’t know how to use the rest of your money? Try adding it to your emergency fund, investing it, or repaying more of your debt. You won’t have to worry about ending up with “leftover” cash and having to decide what to do with it. If you split 100% of your income across your spending categories - 50% for needs, 30% for wants, and 20% for saving/debt repayment - you’ll know exactly what happens to every dollar at the end of the month so you can feel confident you’ve put all your money to good use. Why you should budget your whole incomeīudgeting all of your income is a strategy known as zero-based budgeting and it’s a good way to use your money more efficiently. If you budget all of your income (which you should), these two fields should be the same.

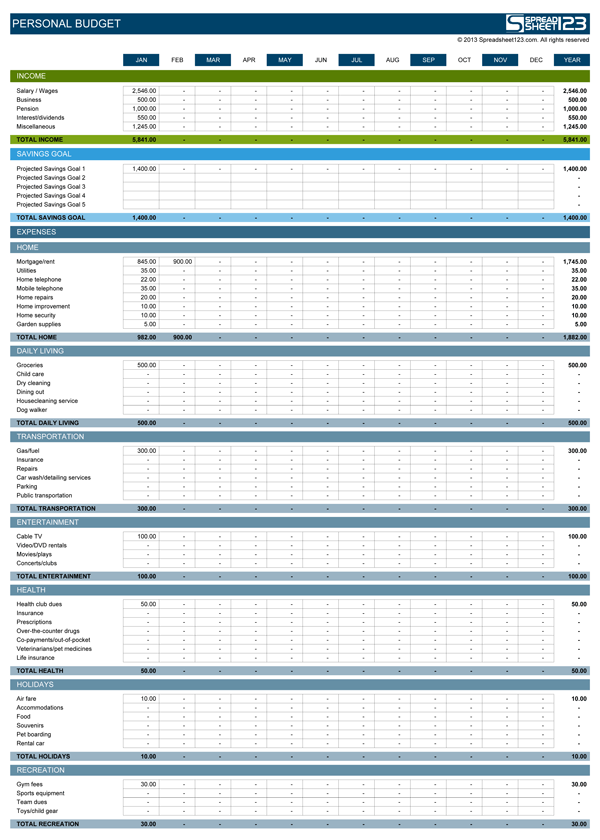

your income subtracts how much you’ve spent from your total monthly income. your budget subtracts how much you’ve spent from how much you’ve budgeted or put into the different budgeting fields. There are two fields for your actual spend: one that compares your spending to your budget and one that compares your actual spending to your overall income. If you’re over budget, look for ways to save money and cut your spending. The “Actual Spend” boxes will be green if you’re under budget or red if you’re over budget. Once you’ve entered all the values, the spreadsheet will tell you how much you have left at the end of the month. What if you don’t really know how much you spend? No worries, just use your transaction history and bank statements to make your best guess for any expenses you’re not sure about. Use the “Leftover Income To Budget” box at the bottom of the spreadsheet to see how much of your total cash you haven’t yet allocated to a budget category (make sure you’re using all of your income!).Track your actual spending throughout the month in the “Spent” column.Add any categories we missed in the “Other” rows.Fill in the blanks for your monthly expenses by putting your typical costs in the “Budgeted” column for each category.Enter your monthly income (after taxes) at the top of the spreadsheet.How to create your personal budget template Now that you know how a 50/30/20 budget (or spending plan) works, the next step is to personalize the budget template. Spending plans tend to be more realistic for most of us. This can be a helpful perspective if you’ve ever found budgeting to be too restrictive. By breaking your total income down into categories, you’re telling yourself how much you can spend in each category - not focusing on what you shouldn’t spend. You can think of your budget as a spending plan. This includes putting money into your emergency fund, investing in retirement accounts, and saving for big financial goals - like the down payment on a car or house. This includes the things you do for fun, such as going to concerts or dining out, and other things that are important to you, like updating your seasonal wardrobe or donating to charity. This includes household expenses that may fluctuate (think: groceries and utilities) as well as fixed costs, like insurance premiums or car payments, and other non-negotiables. Then, it gives a different percentage of your income to each of these expense categories. This is a widely used strategy that’s easy to apply and remember.īasically, it helps you set priorities in your budget and categorize expenses by breaking your spending into three types: needs, wants, and savings. This spreadsheet follows the 50/30/20 budgeting method. Loan Payoff Calculator: How Quickly Can You Repay Your Loan?.Auto Loan Interest Calculator: Monthly Payment & Total Cost.Free monthly budget template (Google Sheets).

How To Pay Medical Bills You Can’t Afford.Best Car Insurance For College Students.Should You Get Home Contents Insurance?.How Much Should You Contribute To Your 401(K).How Much Do You Need To Have Saved For Retirement.The Beginner’s Guide To Saving For Retirement.Investment Calculator: How Much Will You Earn?.How To File A FAFSA As An Independent Student.Best companies for student loan refinancing in 2022.How to refinance your car loan in 7 steps.Best Personal Loans For Excellent Credit.Understanding Overdraft Protection and Fees.6 Best High-Yield Savings Accounts of October 2022.Balance Transfer Calculator: How much can you save?.Credit Score Calculator: Get Your Estimated Credit Score Range.

0 kommentar(er)

0 kommentar(er)